As the year draws to a close, your business may be finding itself in a position where it needs to make strategic financial decisions.

Taking advantage of year-end financing to purchase a new pressure washer or floor care equipment now can be a strategic move. Not only do you receive the cleaning equipment you need, you can also get tax deductions and favorable financing options that provide you with valuable financial incentives to purchase now.

Section 179 Deduction

One of the most significant tax incentives for businesses is the Section 179 Deduction. It allows companies to deduct the full purchase price of qualifying equipment, such as pressure washers and floor care , in the year it was purchased or financed (up to $1.16 million for businesses that spend less than $2.8 million on equipment purchase).

By opting to purchase new equipment using end-of-year financing, you can maximize this deduction to reduce your taxable income, and effectively reduce the cost of your equipment purchase.

-

Equipment Cost: $10,000

-

Section 179 Write Off Expense: $10,000

-

Tax Savings ($10k @ 24% tax rate): $2,400

-

Equipment Cost After Tax Savings: $7,600

Bonus Depreciation

In addition to the Section 179 Deduction, bonus depreciation is another valuable tax benefit to consider. This provision allows businesses to depreciate a substantial portion of the equipment’s cost immediately, often up to 100% of the equipment’s purchase price in the year it was placed in service. By financing your pressure washer at the end of the year, you can take advantage of this benefit to further reduce your taxable income.

Preserve Cash Flow

End-of-year financing enables your business to acquire the essential cleaning equipment it needs while preserving your cash flow for other expenses.

You can spread the cost of the equipment over time, allowing you to maintain sufficient liquidity for day-to-day operations and unexpected expenses. This is particularly beneficial for small and medium-sized businesses that need to manage their working capital carefully.

Limited-Time Financing Options

Year-end financing often includes special, limited-time financing deals that can reduce the cost of payments, reduce interest rates, and help you save on the purchase of your equipment.

In fact, now through November 30, 2023, Northstar is offering 12-Months, 0% Interest financing when you purchase a new Landa Pressure Washer or select Karcher Floor Care Equipment.

With interest rates the highest they have been in decades, having 12 months to pay off your equipment without paying interest can provide your business with huge savings, especially when coupled with your tax deductions.

If you happen to miss this deal, we offer several other customizable financing options throughout the year that can be tailored to fit the unique budget and needs of your business.

Streamlined Approval Process

Our credit application process for pressure washer and commercial cleaning equipment financing is so easy, it can be completed in three simple steps.

Our approval process is also faster and more straightforward than traditional bank loans. This means you can get the pressure washer, floor care or other equipment you need quickly, without the extended approval timelines associated with other financing methods.

Enhanced Cleanliness & Productivity

We all know that maintaining a quality image for your business is just as important as maintaining the equipment that makes your business run.

Whether you require cleaning equipment to ensure that your premises or fleet of vehicles are looking spotless and professional, or are looking to reduce wear and maintain the machinery that is essential to your business operations, we have you covered.

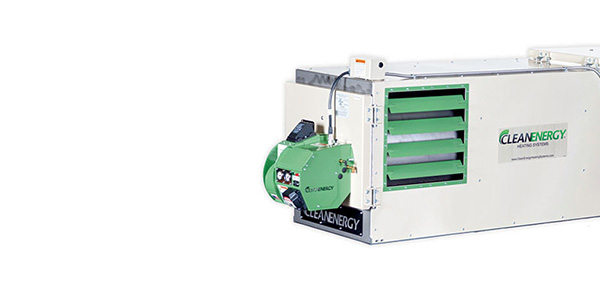

Financing a new Landa pressure washer or Karcher commercial cleaning equipment for your business can help you tackle any cleaning task with greater efficiency, and less labor than the competition. Our equipment is more efficient, more reliable, and requires less maintenance, reducing downtime and repair costs. Not only will you be able to clean more effectively in a shorter period of time, but you’ll be investing in a machine that will last for years beyond the other brands.

To find out more about our equipment offerings and how they can benefit your business, contact one of our product specialists.

Make A Strategic Financial Decision

In conclusion, end-of-year cleaning equipment financing can be a strategic financial decision that can benefit businesses of all sizes. It not only provides you with the equipment you need to enhance your cleaning and maintenance capabilities but also provides substantial tax advantages that can lead to significant savings.

To maximize tax benefits such as the Section 179 Deduction and Bonus Depreciation, consider consulting with a financial advisor or tax professional who can guide you through the intricacies of tax laws in your area and help design a financing plan that aligns with your business objectives.

By leveraging these tax advantages, and our incredible end-of-the-year financing options, you will not only have a chance to clean up your property, but you’ll be able to clean up your finances as well.